Daily Commentary

Commentary prepared by Alloya Investment Services, a division of the wholly owned CUSO of Alloya Corporate Federal Credit Union. Alloya Investment Services is a leading broker/dealer consultant to credit unions.

Monday, July 7, 2025 at 8:00 am CT

Commentary prepared by Tom Slefinger, Market Strategist

Market Indications

Other Market Indicators

| Market Indicators | ||

|---|---|---|

| 2s/5s Tsy Spread | 0.06 | +0.01 |

| 2s/10s Tsy Spread | 0.48 | +0.02 |

| 2s/30s Tsy Spread | 1.01 | +0.04 |

| DJIA-30 | 44,828.53 | +344.11 |

| S&P-500 | 6,279.35 | +51.93 |

| NASDAQ | 20,601.10 | +207.97 |

| Dollar Idx | 97.38 | +0.20 |

| CRB Idx | 299.93 | -0.78 |

| Gold | 3,305.69 | -31.21 |

Daily Commentary

Recap – U.S. equities enjoyed another good week with both the S&P 500 (up 1.7% this week) and Nasdaq Composite (up +1.6%) hitting new highs intra-week. The non-farm payrolls report was hotter than expected at the headline level, which markets interpreted optimistically, although I remain deeply skeptical of the underlying numbers, given the decline in the aggregate workweek and slow growth in total private sector jobs. See this week’s Weekly Relative Value for more color on the labor markets.

Tariff uncertainty persists, as the White House issued new threats of unilateral tariff action for August 1. The Big, Beautiful Bill finally passed, but the final version is even more budget-busting than the original House version last month. And despite all the hoopla, there is nothing much in the Big, Beautiful Bill that is very stimulative. The benefits from no tax on tips, overtime and Social Security are tiny and offset by the Medicaid support pullback (which hits immigrants, but they spend money on food stamps too – the gross domestic product (GDP) data do not discriminate against where you were born). Most of this bill is really just an extension of current policy – the status quo, in other words.

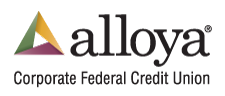

Bond markets reacted, and the 10-year Treasury note sank, with yields up +7 basis points this week. The U.S. dollar continued to slide. The DXY dollar index was down -0.5% to 96.97, reaching early-2022 lows.

Why do I love bonds. The 30-year Treasury bond climbed all the way to 2.6%, which is practically unheard of. It was -0.6% back in November 2021, which in the rear-view mirror was a horrible time to start adding duration to the bond portfolio. But there was so much bad news and deflation risk priced into the market at that point stemming from the pandemic and a prevailing view that the Fed would keep rates at the floor indefinitely. There was no coupon protection back then, but there is today.

Source: Bloomberg

Elsewhere gold was up for the week (+1.8%) and oil rebounded modestly, with West Texas Intermediate (WTI) up +1.2% on the week amid optimism about global growth. Bitcoin was up +7.9% with the general risk-on sentiment.

For a more in-depth analysis of the economy and markets please be sure to read this week’s version of the Weekly Relative Value – The Hawks Cave – to be released later this morning.

The Week Ahead

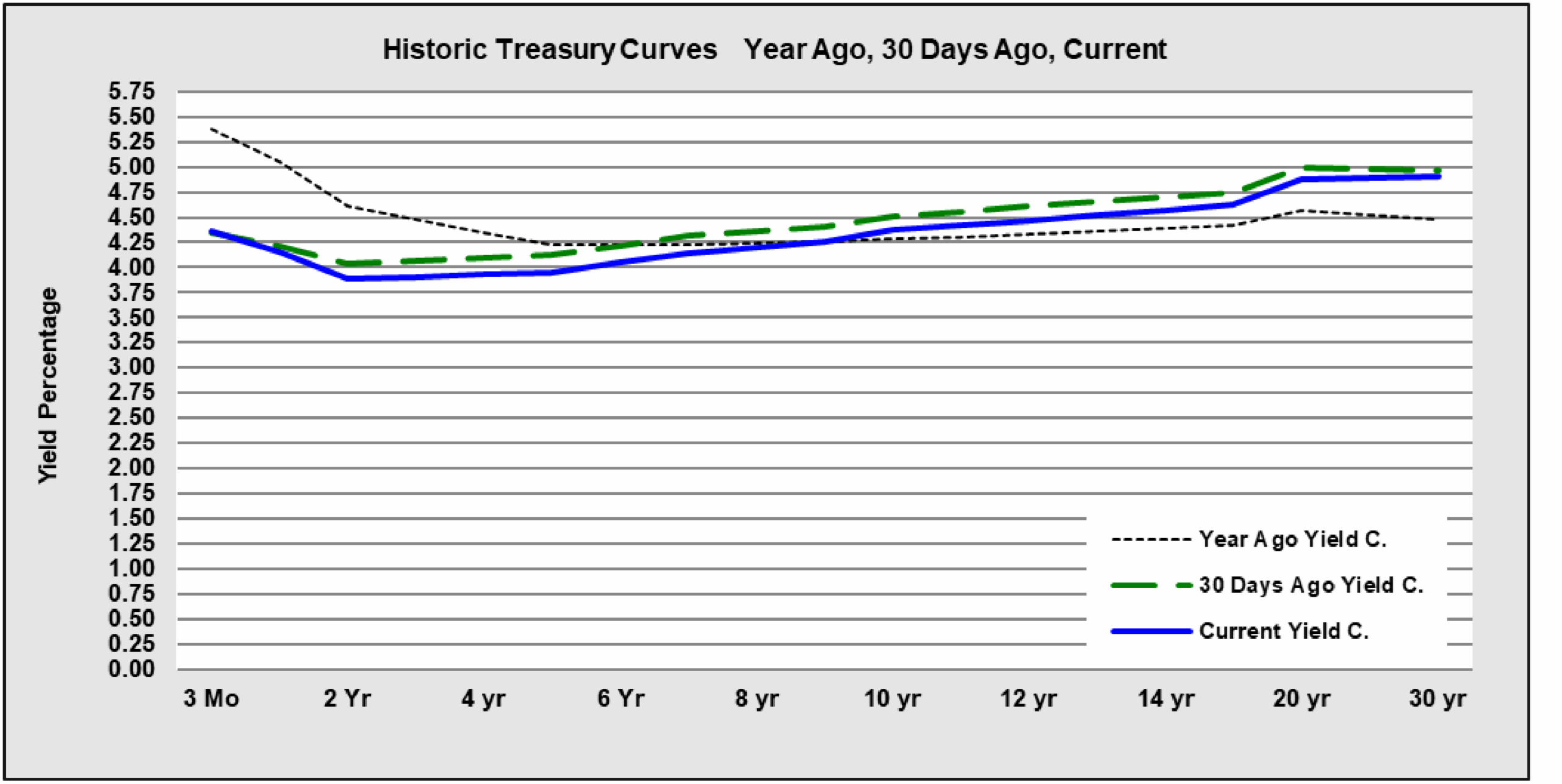

This week will be very light in terms of economic data. The Federal Open Market Committee (FOMC) Minutes (arriving on Wednesday) will shed more light on the divided Fed. Here’s what else is on tap:

- The week will have two interesting surveys, the National Federation of Independent Business (NFIB) Survey (Tuesday) and the New York Fed Inflation Expectations (Tuesday).

- The FOMC Minutes (Wednesday) are always illuminating when the path of monetary policy is so uncertain.

Also, this week the initial 90-day pause President Donald Trump placed on his "Liberation Day" reciprocal tariffs from April 2 is set to expire on July 9. It remains unclear what exactly will happen in terms of trade agreements with other countries. The President has pledged to start issuing unilateral duties on dozens of countries starting today (specifically mentioning the BRICS). It is unclear if July 9 is still the deadline or musings over a further reprieve to August 1. Treasury Secretary Scott Bessent was on the wires saying some countries will be facing those punitive reciprocal levies outlined back on the April 2 “Liberation Day”.

The full economic calendar for the week follows:

Monday, July 7th -----

No major economic releases scheduled.

Tuesday, July 8th -----

6:00 am ET: NFIB Small Business Optimism Index for June.

Wednesday, July 9th -----

7:00 am ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 pm ET: FOMC Minutes, Meeting of June 17-18.

Thursday, July 10th -----

8:30 am ET: The initial weekly unemployment claims report will be released. The consensus is for initial claims to increase to 235,000 from 233,000 last week.

Friday, July 11th -----

No major economic releases scheduled.

Stay tuned and have a great day!

Economic Calendar

July 7 - July 11, 2025: The Week Ahead

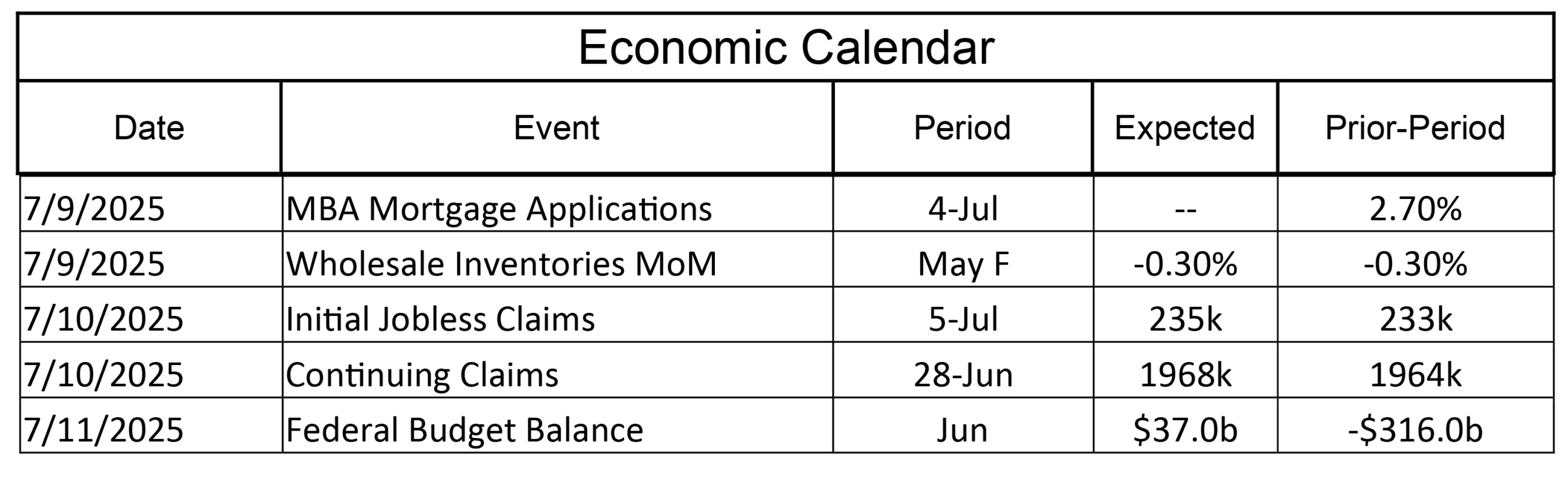

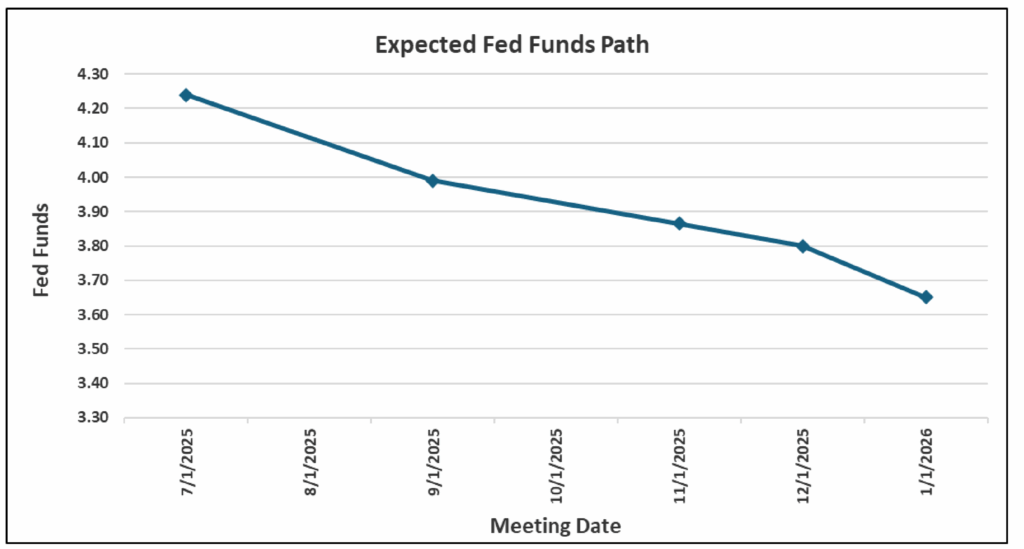

Future Fed Expectations

Source: Bloomberg

| Select Probabilities based on the Futures | |

|---|---|

| Probability of Fed Funds rate CUT on July 30, 2025 | -5% |

| Probability of Fed Funds rate CUT on September 17, 2025 | -68% |

**All quoted rates are indications and are subject to change without notice.

* ISI is a member of the FINRA/SIPC.

The information contained herein is prepared by ISI Registered Representatives for general circulation and is distributed for general information only. This information does not consider the specific investment objectives, financial situations or particular needs of any specific individual or organization that may receive this report. Neither the information nor any opinion expressed constitutes an offer, or an invitation to make an offer, to buy or sell any securities. All opinions, prices, and yields contained herein are subject to change without notice. Investors should understand that statements regarding future prospects might not be realized. Please contact Alloya Investment Services to discuss your specific situation and objectives.