breadcrumbs]

Daily Commentary

Commentary prepared by Alloya Investment Services, a division of the wholly owned CUSO of Alloya Corporate Federal Credit Union. Alloya Investment Services is a leading broker/dealer consultant to credit unions.

Friday, January 16, 2026 at 8:00 am CT

Commentary prepared by Tom Slefinger, Market Strategist

Market Indications

Other Market Indicators

| Market Indicators | ||

|---|---|---|

| 2s/5s Tsy Spread | 0.21 | 0.01 |

| 2s/10s Tsy Spread | 0.61 | 0.01 |

| 2s/30s Tsy Spread | 1.24 | 0.01 |

| DJIA-30 | 49,442.44 | +292.81 |

| S&P-500 | 6,944.47 | +17.87 |

| NASDAQ | 23,530.02 | +58.27 |

| Dollar Idx | 99.20 | -0.12 |

| CRB Idx | 301.75 | -5.07 |

| Gold | 4,614.04 | -2.57 |

Daily Commentary

Recap — The stock market rose yesterday with the S&P 500 gaining 0.2% while Nasdaq rose 0.2%. The Dow jumped 0.5%. The small cap sector continues to lead the way with a gain of 0.86% and has beat the S&P 500 for a 10th straight session, its longest such streak since 1990. Notably, year to date, the Russell 2000 has risen 7.76% versus only 1.45% for the S&P 500. Overall, markets are calm. Strong profit growth and a cheap cost of capital continue to trump other considerations, including policy uncertainty and over-investment risk, at least for now.

The DXY Dollar Index is stable around 99.0. Gold looks anchored around $4,600 and silver around $91, a bit below the highs seen earlier this week. Oil appears to be settled near the $60 mark, and crypto markets are largely flat versus yesterday. Bitcoin is trading around $95,600.

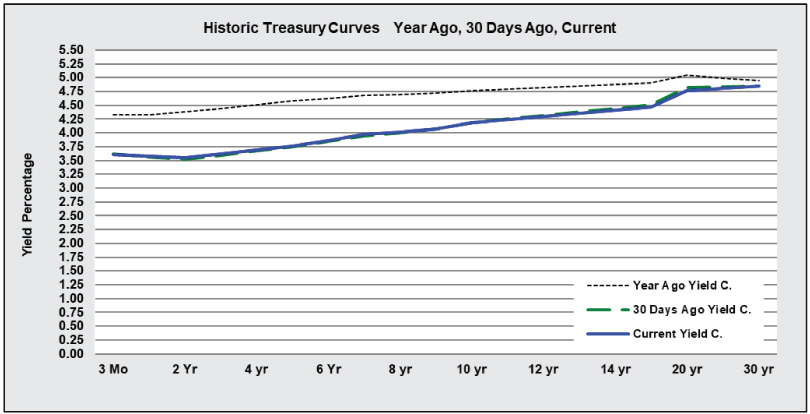

The bond market remains EXTREMELY calm. Yesterday, the benchmark 10-year Treasury yield rose settled at 4.17%. I don’t know about you, but it feels like every time I look at the 10-year yield these days, it’s 4.14% plus or minus a few basis points. In fact, that’s a lie: I do know. Over the last 30 trading days, the high closing yield has been 4.19% and the low has been 4.11%. That paltry 8 basis point range. In a word: BORING.

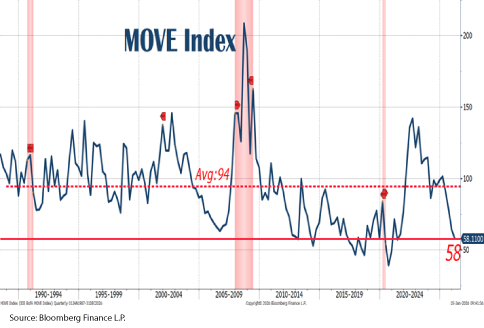

While there appears to be plenty of uncertainty about key issues (Fed policy, the identity of the next chair, the labor market, tariffs, etc.), that doesn’t appear to be reflected in fixed-income implied volatility, at least judging by the Merrill Lynch Option Volatility Estimate (MOVE) Index.

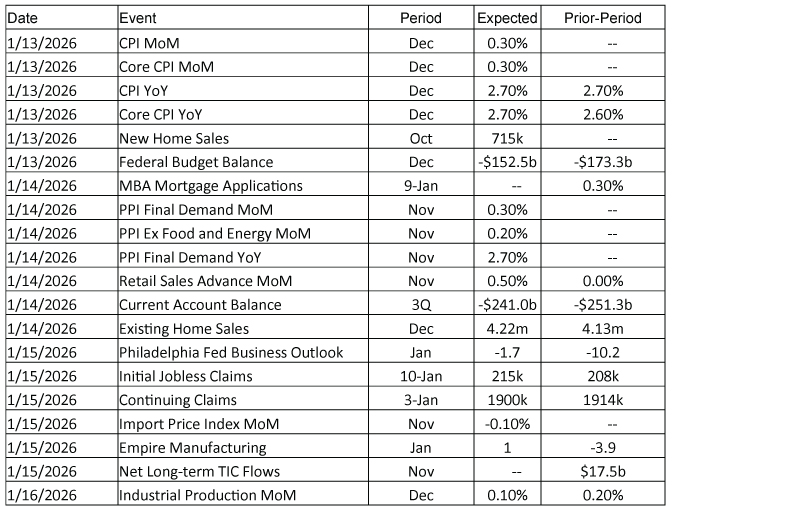

As far as the economy goes, the soft survey data for January give us the first real preview of any 2026 activity, and macro bulls found much to like. Yesterday, the Empire State and Philly Fed Manufacturing Indexes were both singing from the same bullish song sheet for output — but not for employment. All of this is consistent with the “jobless growth” themes we’ve been seeing in both the gross domestic product numbers.

The headline for Empire State came in at +7.7 against an expectation of +1.0. The Philly Fed’s Manufacturing Index came in hot as well at +12.6, much higher than the -1.4 expected and a huge improvement from last month’s dismal -8.8 print. The +21.4 improvement for the Philly Fed Index is the biggest one-month gain since January 2025.

We also received the stale import price data for November, coming in at +0.1% year over year, and this was higher than expectations of a -0.2% drop in prices over the past year. This is the first year-over-year uptick since March, after experiencing a six-month streak of flat or negative readings, but overall, this isn’t a driver of inflation.

In other news, Taiwan has made an agreement with the U.S. that will see U.S. importers paying a 15% tariff on Taiwanese products. The 15% number might have additional significance if the U.S. Supreme Court rules some tariffs illegal; one alternative route is for President Trump to impose a universal 15% tariff. Taiwan pledged to increase investment in the U.S. Some of this will be already planned investment, and markets have learned not to take such announcements as definitive.

More on the K-shaped economy. Goldman’s Q4 profit rose by +12% to $4.6 billion due to a surge in investment-banking fees and a strong quarter in equities trading. Likewise, Morgan Stanley’s profits rose +18% to $4.4 billion, with investment-banking fees jumping by nearly +50%!

The newest wrinkle is that Wall Street is combining blockbuster profits with a renewed push to reduce headcount. Bloomberg reports that the six largest U.S. banks cut a combined 10,600 jobs last year, the most since 2016, as executives focused on efficiency and cost control, typically the biggest expense line item. So, trading and capital-market engines are generating record-level cash flows for shareholders and senior talent, while the industry simultaneously tightens labor. This in turn highlights how capital-markets activity can thrive even as consumer sentiment and the labor market sour.

Stay tuned and have a great day!

Economic Calendar

January 12 - 16, 2026

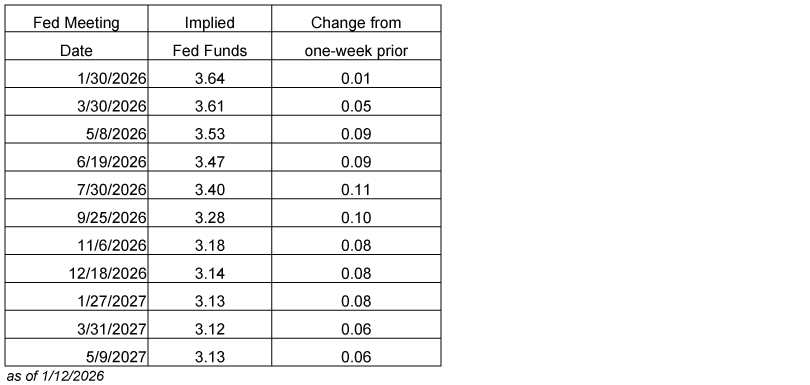

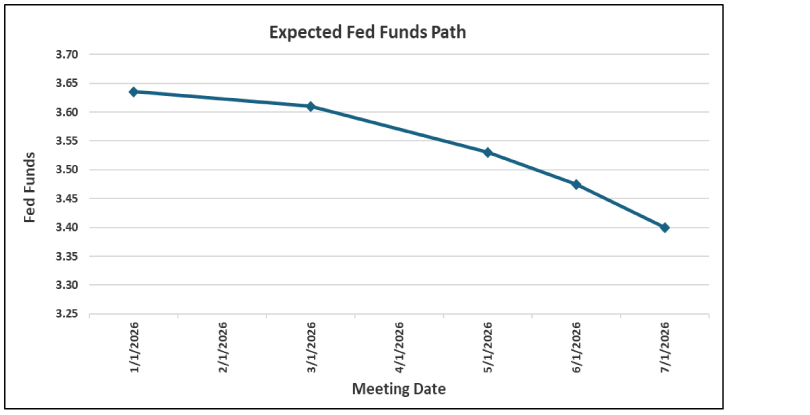

Future Fed Expectations

Source: Bloomberg

| Select Probabilities based on the Futures | |

|---|---|

| Probability of Fed Funds rate CUT on January 28, 2026 | -05% |

| Probability of Fed Funds rate CUT on March 18, 2026 | -21% |

**All quoted rates are indications and are subject to change without notice.

* ISI is a member of the FINRA/SIPC.

The information contained herein is prepared by ISI Registered Representatives for general circulation and is distributed for general information only. This information does not consider the specific investment objectives, financial situations or particular needs of any specific individual or organization that may receive this report. Neither the information nor any opinion expressed constitutes an offer, or an invitation to make an offer, to buy or sell any securities. All opinions, prices, and yields contained herein are subject to change without notice. Investors should understand that statements regarding future prospects might not be realized. Please contact Alloya Investment Services to discuss your specific situation and objectives.