Daily Commentary

Commentary prepared by Alloya Investment Services, a division of the wholly owned CUSO of Alloya Corporate Federal Credit Union. Alloya Investment Services is a leading broker/dealer consultant to credit unions.

Tuesday, October 28, 2025 at 8:00 am CT

Commentary prepared by Tom Slefinger, Market Strategist

Market Indications

Other Market Indicators

| Market Indicators | ||

|---|---|---|

| 2s/5s Tsy Spread | 0.12 | +0.01 |

| 2s/10s Tsy Spread | 0.49 | 0.00 |

| 2s/30s Tsy Spread | 1.06 | 0.00 |

| DJIA-30 | 47,544.59 | +337.47 |

| S&P-500 | 6,875.16 | +83.47 |

| NASDAQ | 23,637.46 | +432.59 |

| Dollar Idx | 98.68 | -0.10 |

| CRB Idx | 301.54 | -1.44 |

| Gold | 3,903.55 | -79.97 |

Daily Commentary

Recap – In advance of the key earnings reports from Big Tech companies and the Fed’s interest rate decision on Wednesday, stocks started the week with nice gains. The S&P 500 gained 1.2%, the Dow 0.7% and the Nasdaq 1.9%. Meanwhile, gold is back around the $4,000 per ounce mark. The U.S. dollar weakened slightly to 98.63.

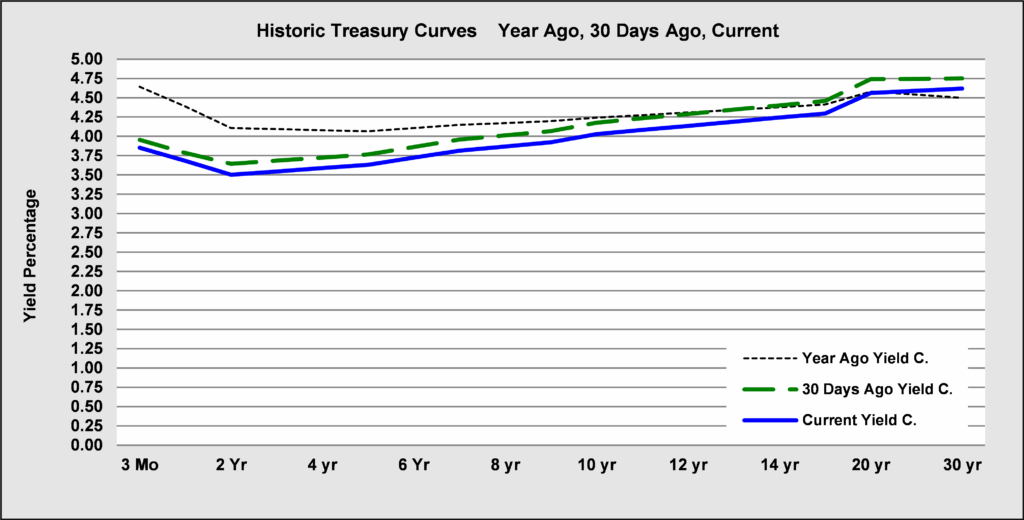

In the fixed income arena, the benchmark Treasury yield continues to grind lower. Currently the yield is 3.97%. At the long end, the long bond (30-year) is trading at 4.55%. At the front-end, the twos and fives are yielding 3.48% and 3.60%, respectively.

In other news, the IMF suggested that the U.S. government debt-to-GDP ratio will exceed that of Italy by the end of the decade. There is no reason to suppose that this IMF forecast is more accurate than any other IMF forecast, but the trend is clear. See this week’s Weekly Relative Value, “Numb to our Dysfunction”, for more information on our debt crisis.

Meanwhile, the white-collar AI bloodbath is happening faster than many expected. As discussed in this week’s Weekly Relative Value, Amazon plans to replace 600,000 U.S. workers with robots by 2033 while doubling product sales. The company aims to automate 75% of operations and eliminate 160,000 roles by 2027, saving 30 cents per item and $12.6 billion over three years. In that context, it was announced yesterday that Amazon will fire 30,000 employees (nearly 10% of Amazon's corporate workforce of roughly 350,000). In the absence of official U.S. labor data, such reports assume increased importance. Keeping fear of unemployment in check is critical to keeping U.S. consumers spending. One set of job losses may not change that, but if this were to broaden out, it would be concerning.

As the Wall Street Journal reported in “More Big Companies Bet They Can Still Grow Without Hiring”, some of the country's top employers don't see the need to hire. JPMorgan Chase, Walmart, Target and Paramount, among others, have said in recent weeks that they expect to hold down headcount. In other words, don't bother looking for a job. Blame AI.

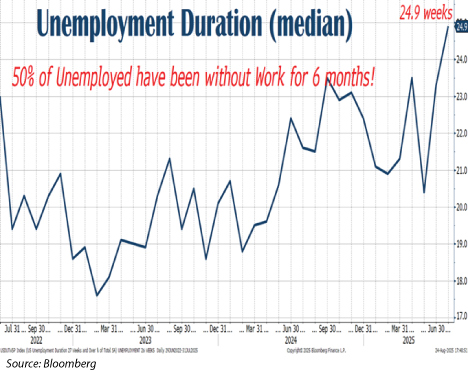

This explains why long-term unemployment (unemployed people who have been without a job for 27+ weeks) in the U.S. has hit 25% as of August 2025, a three-year high. Even though overall unemployment is only up slightly, when this metric reached above 25% in 2009, the U.S. was already over a year into recession. The current rise coincides with widespread AI adoption, companies cutting junior roles and hiring freezes across tech and professional services. The 2009 comparison matters because that's when structural unemployment became clear as certain jobs simply weren't coming back. We may be seeing a similar dynamic where AI permanently reduces demand for certain skill levels, leaving workers searching for positions that no longer exist. In other words, if you receive the dreaded pink slip, it’s become increasingly difficult to find a new job.

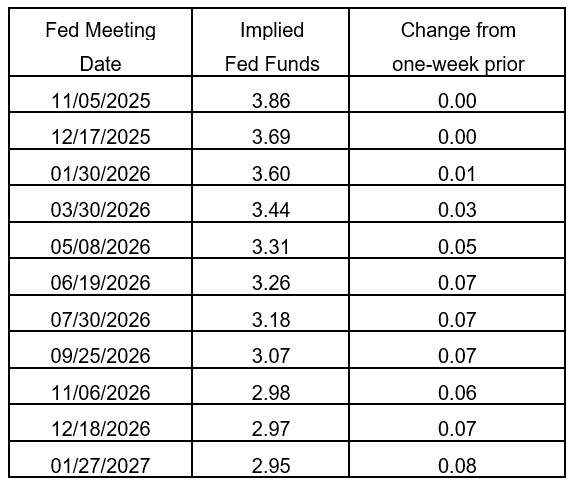

As mentioned yesterday in this space, Powell’s term as head of the Federal Reserve ends in a little more than six months. According to Scott Bessent, the short list has been whittled down to five — former Fed Governor Kevin Warsh; current board members Christopher Waller and Michelle Bowman; the chairman of the Council of Economic Advisers, Kevin Hassett and Rick Rieder, the head of fixed income at BlackRock. Odds have shifted for months, and there’s no clear favorite.

This is the problem: The president might want an outsider to shake things up (meaning Hassett or Rieder), but they do not have any experience in central banking. That said, the two key attributes are a willingness to do what Trump wants and credibility with the markets, even if they satisfy the first. It’s a difficult balancing act. The decision will be key to ensuring market confidence.

Stay tuned and have a wonderful day!

Economic Calendar

October 27 - 31, 2025

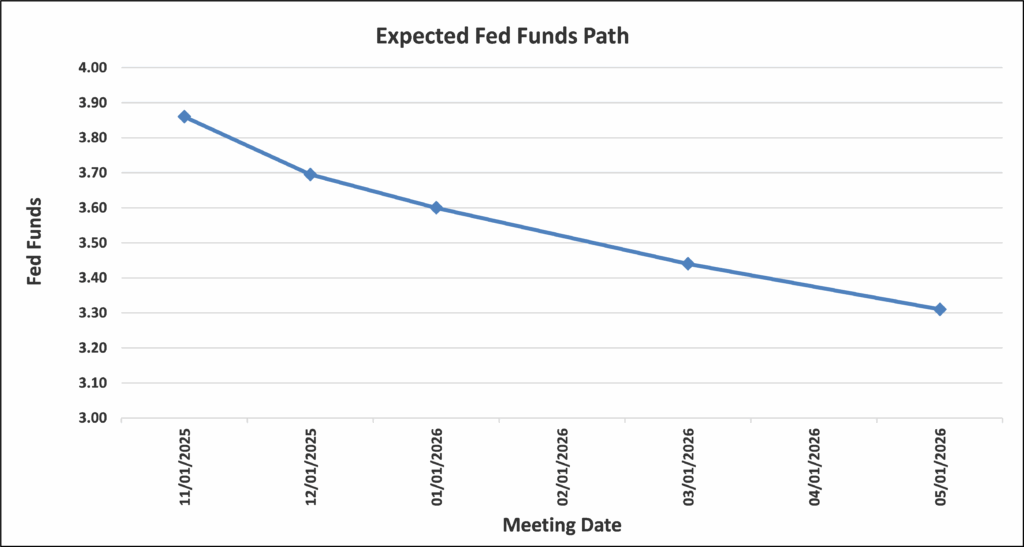

Future Fed Expectations

Source: Bloomberg

| Select Probabilities based on the Futures | |

|---|---|

| Probability of Fed Funds rate CUT on October 29, 2025 | -97% |

| Probability of Fed Funds rate CUT on December 10, 2025 | -98% |

**All quoted rates are indications and are subject to change without notice.

* ISI is a member of the FINRA/SIPC.

The information contained herein is prepared by ISI Registered Representatives for general circulation and is distributed for general information only. This information does not consider the specific investment objectives, financial situations or particular needs of any specific individual or organization that may receive this report. Neither the information nor any opinion expressed constitutes an offer, or an invitation to make an offer, to buy or sell any securities. All opinions, prices, and yields contained herein are subject to change without notice. Investors should understand that statements regarding future prospects might not be realized. Please contact Alloya Investment Services to discuss your specific situation and objectives.