Daily Commentary

Commentary prepared by Alloya Investment Services, a division of the wholly owned CUSO of Alloya Corporate Federal Credit Union. Alloya Investment Services is a leading broker/dealer consultant to credit unions.

Wednesday, April 24, 2024 at 8:00 am CT

Commentary prepared by Tom Slefinger, SVP, Director of Institutional Fixed Income Sales, Registered Representative of ISI*, Alloya Investment Services

Market Indications

Other Market Indicators

| Market Indicators | ||

|---|---|---|

| 2s/5s Tsy Spread | -0.31 | +0.01 |

| 2s/10s Tsy Spread | -0.35 | +0.01 |

| 2s/30s Tsy Spread | -0.25 | +0.00 |

| DJIA-30 | 38,239.98 | +253.58 |

| S&P-500 | 5,010.60 | +43.37 |

| NASDAQ | 15,451.31 | +169.30 |

| Dollar Idx | 106.03 | -0.04 |

| CRB Idx | 298.11 | -0.04 |

| Gold | 2,301.98 | -25.34 |

Daily Commentary

Recap – A very soft set of preliminary Purchasing Managers’ Indexes (PMI) for April, with manufacturing back into contraction and services slumping to a five month low, boosted bonds yesterday. Also, a strong demand 2-year auction helped. The U.S. Treasury auctioned a record high $69 billion two-year Treasury notes which attracted strong demand. The bid-to-cover ratio (2.66x) was the highest since December. This shows that Treasury demand is alive and well, and that 5% in the 2-year is an excellent buying opportunity. Those who worry about an imminent “buying strike” ignore the importance of Treasuries as the world’s “safe asset” and its role as the key source of liquidity in the global financial system, which is a source of long-term structural demand. The Treasury is set to sell a record $70 billion of five-year notes later today and $44 billion of seven-year notes on Thursday which will further test buyer appetite.

Yesterday’s tech-led bounce has carried through to the overnight action with U.S. equity futures in the green (Nasdaq with a +0.6% advance so far). Tesla’s earnings, despite missing sales and profit estimates in Q1, focused on plans to accelerate the production of lower-cost models. Adding positive momentum was the upbeat guidance from Texas Instruments and a beat out of Visa. The wave of earnings releases this week continues, with the likes of Meta, Ford, Boeing and IBM on deck today.

On the economic docket, yesterday’s April S&P Global PMI readings were a big downside surprise. U.S. manufacturing activity fell back into contraction territory, slumping to 49.9 from 51.9 and a big miss compared to the 52.0 consensus estimate. Services also surprised to the downside, with the index slowing to 50.9 from 51.7 (consensus was also 52.0). While the weakness from manufacturing was not good, the bigger development, at least from my perch , was the weakening in the service economy, given this has been the pillar keeping the overall economy afloat. These PMI readings point to waning momentum as the second quarter began.

Here is what S&P Global had to say:

“U.S. business activity continued to increase in April, but the rate of expansion slowed amid signs of weaker demand. The latest rise in output was the smallest in the year-to-date reflecting reduced rates of growth and falling orders in both the manufacturing and services sectors. April saw an overall reduction in new orders for the first time in six months. Companies responded by scaling back employment for the first time in almost four years, with business confidence also waning to the lowest since last November.”

“Rates of inflation generally eased at the start of the second quarter, with both input costs and output prices rising less quickly at the composite level. That said, manufacturing input cost inflation hit a one-year high.”

Also worth highlighting, new home sales in March kicked off the spring homebuying season by jumping +8.8% month-over-month (seasonally adjusted) to +693,000 annualized units, against the consensus of +670,000 units. All regions contributed to the upswing in March, with the (highly volatile) Northeast up +27.8% month-over-month, the West up +8.6%, the South up +7.7% and the Midwest lagging the pack at +5.3%. Notably, homes costing $500,000 or more made up 39% of transactions (up from 36% in February). Builders are getting some traction by offering substantial interest rate discounts on their loans to buyers. The median new home price rose +6.0% month-over-month on the strengthening in demand, up to $430,000.

Source: Bloomberg

Overall, this looks like a “clean” signal from new home sales, with the rise in aggregate sales supported by broad-based regional strength and a consistent move in prices and inventories. That said, it’s impossible to look at the new housing market in isolation without acknowledging the distortions caused by the completely stagnant existing home market, given the great number of homeowners locked into their ultra-low-rate mortgages and trapped in their current homes.

Have a great day!

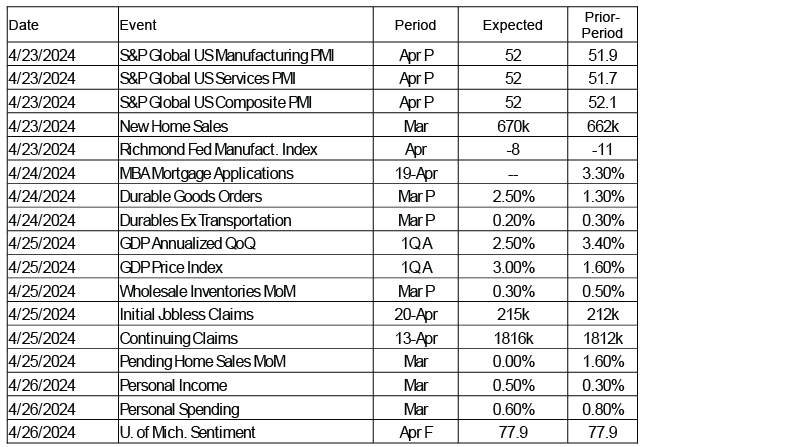

Economic Calendar

April 22 - 26, 2024: The Week Ahead

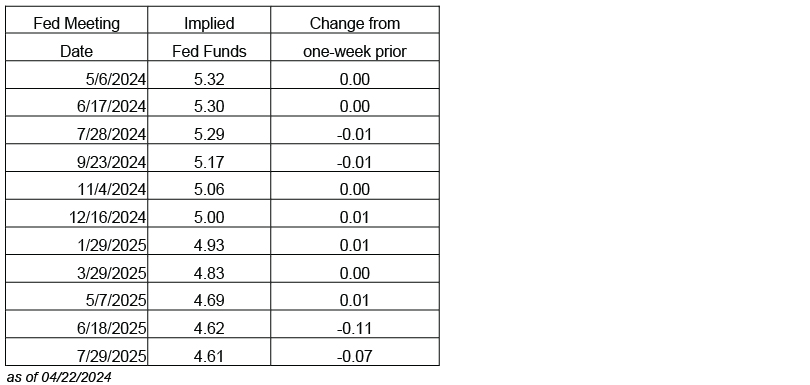

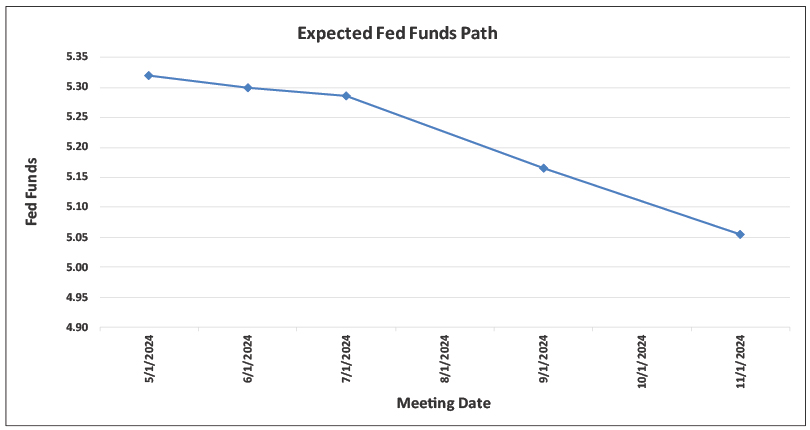

Future Fed Expectations

Source: Bloomberg

| Select Probabilities based on the Futures | |

|---|---|

| Probability of Fed Funds rate CUT on May 1. 2024 | -3% |

| Probability of Fed Funds rate CUT on June 12, 2024 | -16% |

**All quoted rates are indications and are subject to change without notice.

* ISI is a member of the FINRA/SIPC.

The information contained herein is prepared by ISI Registered Representatives for general circulation and is distributed for general information only. This information does not consider the specific investment objectives, financial situations or particular needs of any specific individual or organization that may receive this report. Neither the information nor any opinion expressed constitutes an offer, or an invitation to make an offer, to buy or sell any securities. All opinions, prices, and yields contained herein are subject to change without notice. Investors should understand that statements regarding future prospects might not be realized. Please contact Alloya Investment Services to discuss your specific situation and objectives.